IN A NUTSHELL: Part 1 of 3 — The economic environment has dramatically reshaped the external environment of many companies, including yours. Use this framework to stress test your current business strategies so that you are well-positioned for the new realities. IN A NUTSHELL: Part 1 of 3 — The economic environment has dramatically reshaped the external environment of many companies, including yours. Use this framework to stress test your current business strategies so that you are well-positioned for the new realities.

Part 2 of this series can be found here. Part 3 of this series can be found here. |

We all know that the world has changed dramatically over the last 24 months. Things are happening in the external business environment which have never happened before, and words like “unprecedented”, “meltdown” and “crisis” have become the fodder of normal everyday conversations. In this type of environment, which is still rapidly evolving, it is wise not to take anything for granted. Not even the things which you’ve always taken for granted. Especially not the things which you’ve always taken for granted. In the next 3 part series of posts, I’d like to walk briefly through some thought processes for thinking about risk in your company and developing plans to deal with those risks. Intelligently dealing with risk really involves four key thought processes:

- Contemplating the range of scenarios which COULD happen,

- Actively considering, as best possible, the likelihood that each of those WOULD happen,

- Developing strategies to detect as early as possible that one of those scenarios IS happening, and

- Having a mitigation or response plan which can be quickly executed in the case the scenario DOES happen.

In this first post I will start at a high level, that of risks to your business strategies. In the next post, I will discuss how to think about risks to your daily business operations. In the third and last post, I will discuss risks to your organization and your teams.

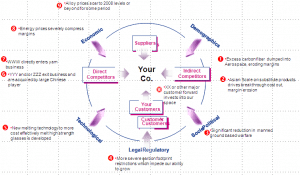

Every company hopefully has a set of strategies which it formulates and executes to help it meet its objectives. (For the purposes of this post I am going to assume that your company already has a set of clearly articulated strategies which you have already agreed on.) A good set of strategies is formulated based on your company’s posititioning relative to its external environment (customers, suppliers, competitors, regulatory, etc.)

In the same way that Michael Porter’s Five Forces Model is a useful framework for developing your company strategies, it can also be a good tool for “stress testing” your strategies. Pull out the output documents from your company’s last strategic planning session and briefly review as a team the course you charted at that time. After reviewing your strategies, go around each of the five segments of Porter’s model and brainstorm several of the most extreme and surprising changes which you could imagine happening to your company’s environment. I advise you to really step back and detach your self from the situation; it may help you to think more broadly if you imagine what could happen to a competitor, as opposed to yourself. (For whatever reason, people never seem to be pragmatic or realistic enough about the possibility of bad things actually happening to themselves, but find it easy to imagine them happening to someone else.) The range of scenarios you come up with should be extreme and include such things as key customers going bankrupt, drastic inflation in key raw materials, significant overhauls in regulatory constraints, or an indirect competitor totally obsoleting your business model. I would advise shooting for two to four scenarios for each element of the external environment, so that you end up with a list of between 10 and 15 scenarios which could potentially play out.

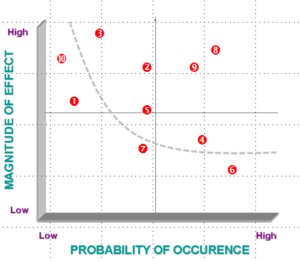

Now think about each of these environmental changes from two different dimensions: (1) How likely is it actually to happen?, and (2) What would the impact be on our company and our current strategies? Arrange your situational possibilities on a two axis grid with the x-axis representing the perceived likelihood and the y-axis representing the potential impact to your company and its current strategies. Try to force some segregation, so that everything isn’t automatically highly likely and high impact. You should end up with a grid looking something like the figure below:

Divide the cluster roughly in half, and think carefully about the how would you cope with the possibilities in the right upper quadrant of the plot:

- Would our current strategies still be effective in the event that the scenario played out?

- If not, how could we modify our strategies to make them more capable in the new environment?

- How would we know if one of those scenarios were actually beginning to develop?

- Would any of these situations offer up any new opportunities for competitive advantage for our company?

I recommend assigning key members of your senior leadership team the responsibility of continuously monitoring one each of these potentially high impact trends so that you can mobilize your strategic shifts as early as possible in the event of occurence. Using this kind of review periodically (at a minimum annually) will help you to keep your company’s strategies tuned to your rapidly evolving environment and will make sure your company remains positioned to respond to emerging threats and to capitalize on new opportunities in your external environment. How has your company adopted its strategic planning and review process in response to the current economic environment?

Check back soon for Part 2 of this series, Operational Execution.

I love this idea. Any tool that can bring rigor in identifying and ranking potential risks to a process that is, at best, chaotic and driven by an outspoken few is useful. I look forward to the next two parts of this series and will certainly point them out on my blog for my, like, 3 readers when the set is complete.

I think the idea of thinking of risks to a competitor is a great way of getting around the issue of being wed to your strategies. I think that many would still be vulnerable to blind spots, however: I wonder how many banks would have identified “home prices falling 20% or more” and “access to credit markets frozen” as risks even using such a process?

Thanks Greg. You are correct that the biggest blind spot of any risk assessment exercise is thinking through accurately and honestly the range of things which COULD happen. It will probably always be human nature to be optimistic rather than fatalistic, but hopefully the realities of recent economic events will help decision makers thing more broadly about potentially devastating developments.

I love this idea. Any tool that can bring rigor in identifying and ranking potential risks to a process that is, at best, chaotic and driven by an outspoken few is useful. I look forward to the next two parts of this series and will certainly point them out on my blog for my, like, 3 readers when the set is complete.

I think the idea of thinking of risks to a competitor is a great way of getting around the issue of being wed to your strategies. I think that many would still be vulnerable to blind spots, however: I wonder how many banks would have identified “home prices falling 20% or more” and “access to credit markets frozen” as risks even using such a process?